VAT Number

What is a VAT identification number? Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT. Check whether a VAT number is valid Check how VAT number is called in national language of each EU country Who needs a VAT number?

What is a VAT number?

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest payments, and profits as well as materials. As with other consumption taxes, including goods and services tax (GST) or retail sales taxes, consumers pay value-added tax.

How VAT works and is collected (valueadded tax) Novashare

VAT tax number: meaning and format. Value-added tax identification number (VATIN), or simply VAT, is a unique identifier used by the government that links to every taxable person or registered business. A VAT number allows tax authorities in the EU to track the movement of goods and associated tax liabilities on trading businesses.

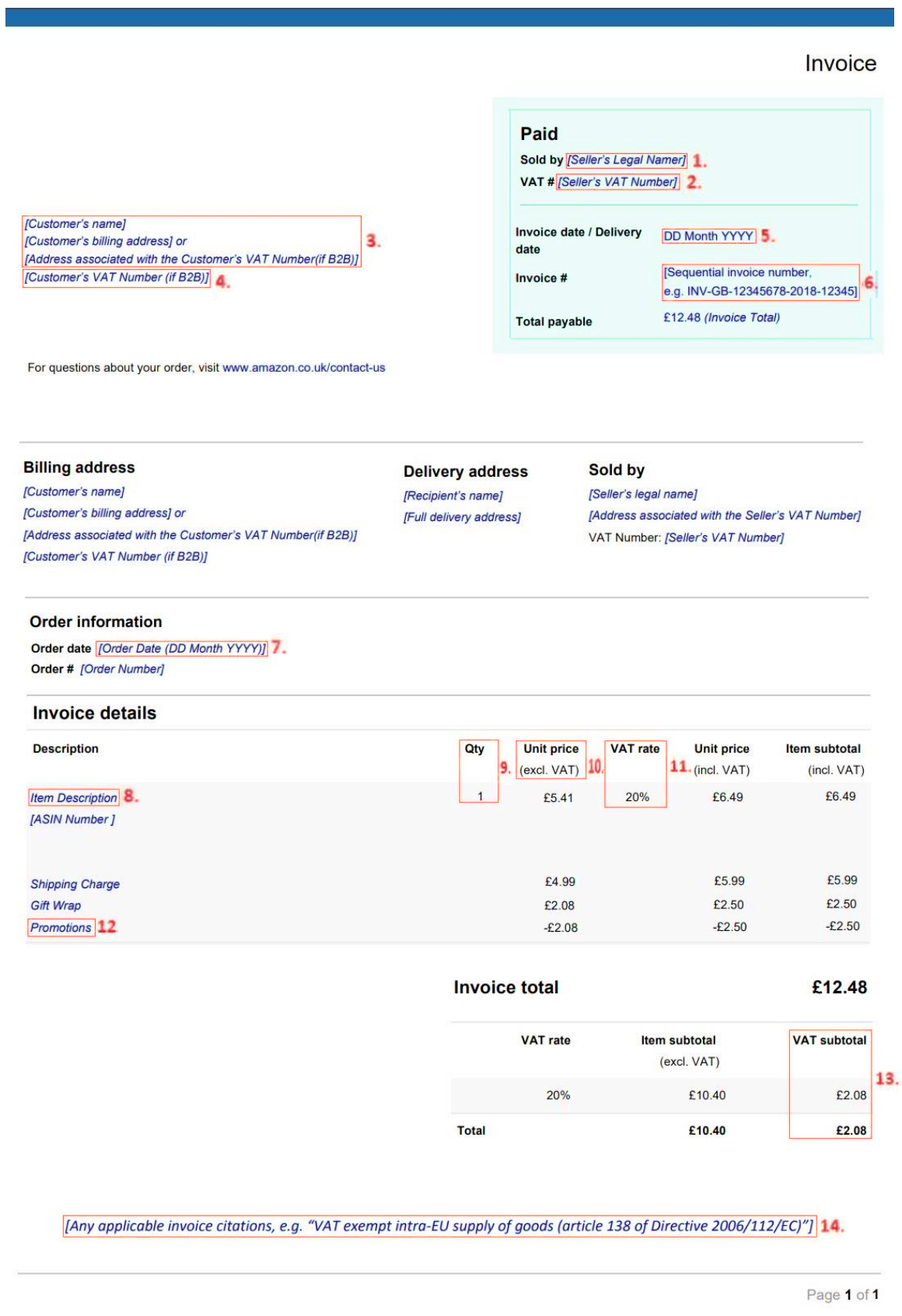

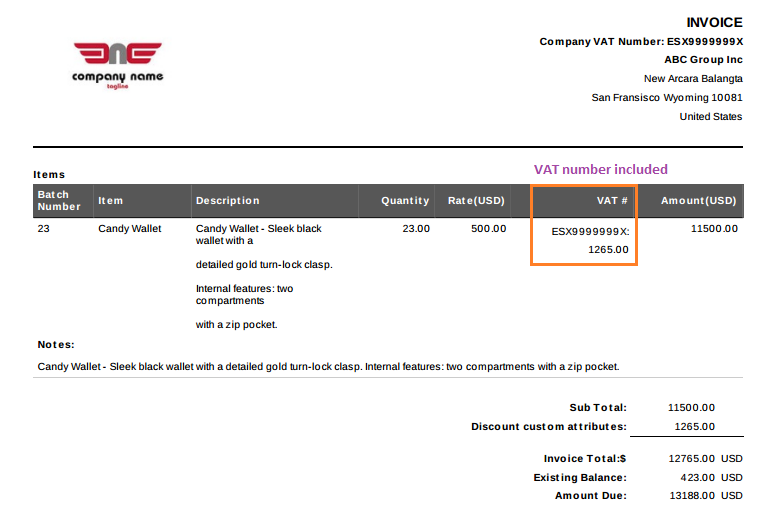

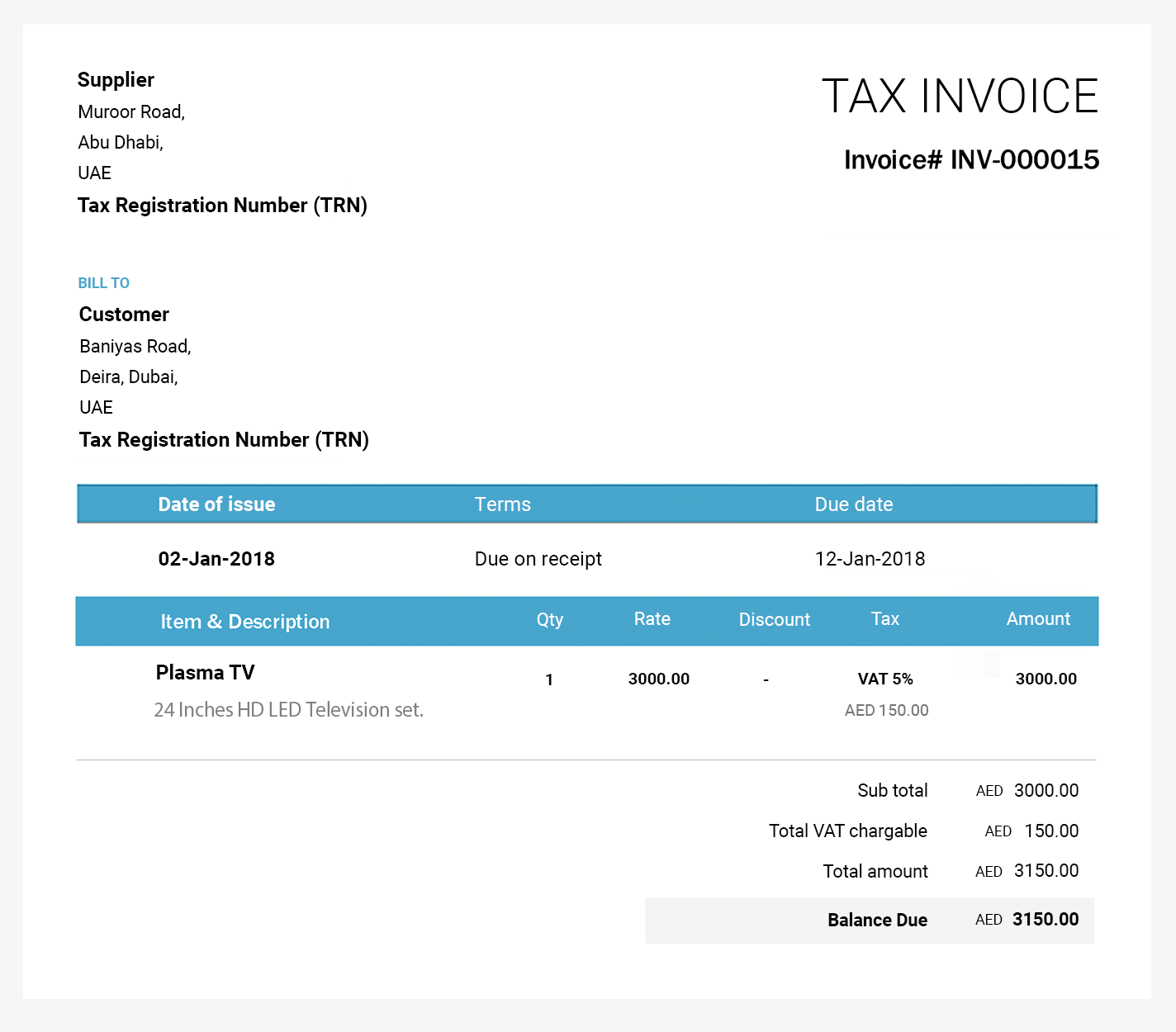

A ValueAdded Tax (VAT) Invoice GeekSeller Support

[1] Example: VAT numbers for Germany start with the letters "DE" and are followed by 9 digits, such as DE123456789. Example: The VAT country code for Estonia is EE, so an Estonian business's VAT number may look like EE93810511 The letters at the start of a VAT number may change based on the language you're using.

VATnumber. What is that and how to get it? CloudOffice

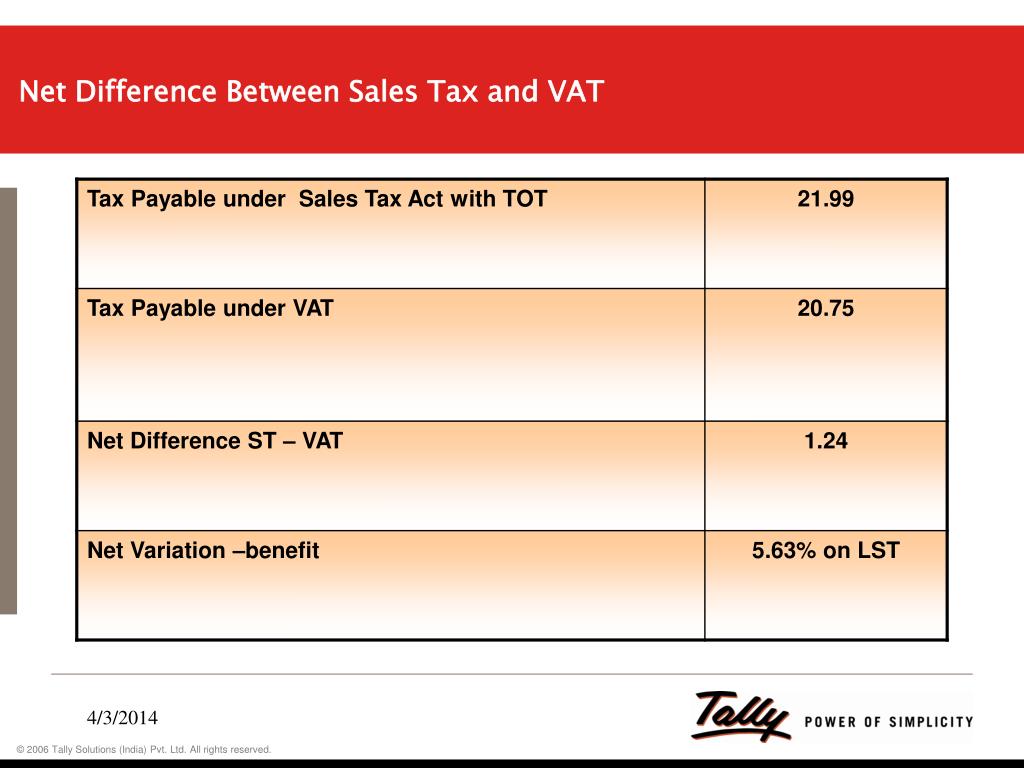

Both sales tax and VAT are types of indirect tax - a tax collected by the seller who charges the buyer at the time of purchase and then pays or remits the tax to the government on behalf of the buyer. Sales tax and VAT are a common cause of confusion within the corporate tax community.

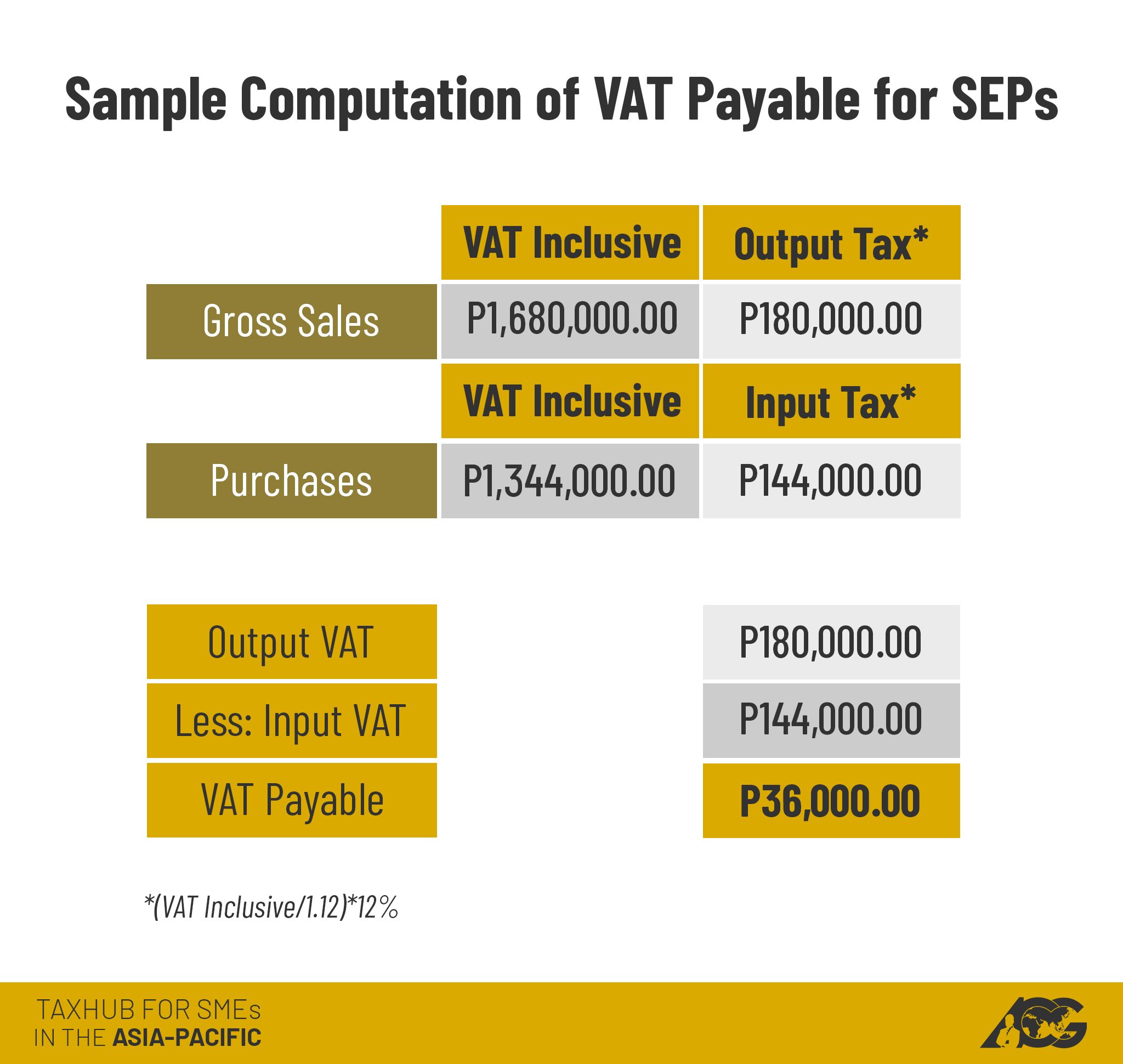

AskTheTaxWhiz VAT or nonVAT taxpayer?

This document list downs the local name of the VAT numbers and its formats. 9 characters. The first character is always 'U'. le numéro d'identification ą la taxe sur la valeur ajoutée BTW - identificatienummer (BTW, TVA, NWSt) 10 characters. Prefix with zero '0' if the customer provides a 9 digit VAT number.

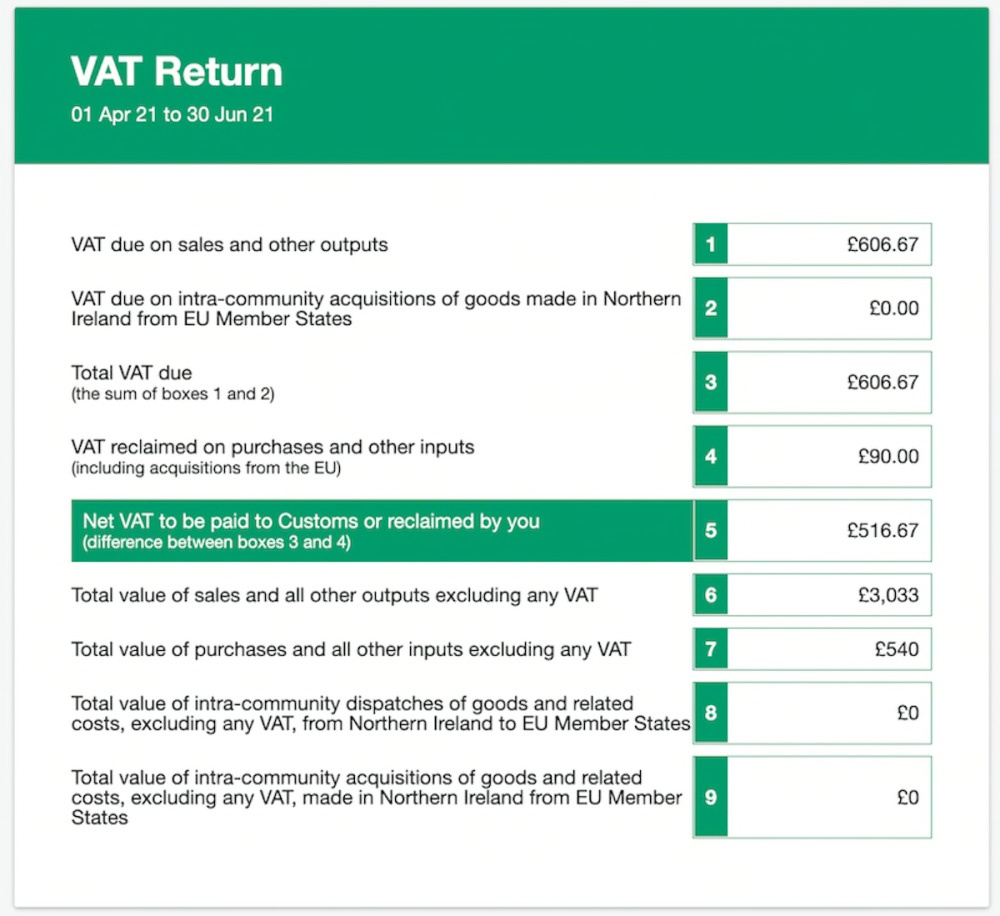

VAT Return Get hands on help with your VAT Return

What is a VAT number? The value added tax registration number (abbreviated 'VAT number', or 'VAT reg no.') is the individual identification number of companies that operate internationally within the EU. A VAT number enables international tax authorities to track and tax the transactions of these companies.

How to Add VAT number to your Etsy Account VAT Etsy UK Etsy UK Sales Tax es65 YouTube

A: No, an Income Tax Number and VAT number are two totally different tax types. Income tax registration is compulsory whereas a VAT registration number depends on quite a few factors. The business must however be registered for income tax before a tax clearance or VAT number can be applied for.

Tax Word and 2023 Number on Calculator. Pay Tax or Vat in 2023 Years Stock Image Image of bill

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

Include VAT Number In Invoices

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

PPT VAT Accounting PowerPoint Presentation, free download ID771468

A value-added tax, or VAT, is a tax on products or services when sellers add value to them. In some countries, VAT is called goods and services tax, or GST. Similar to a sales tax or.

How VAT works and is collected (valueadded tax) Perfmatters

VAT registration number. Also known as a VAT registration number or VRN, your number is assigned when you register your business for taxes. So, it will appear on the tax registration documents you receive from the member state where you've registered. The registration number can have between 4 and 15 digits total.

How VAT works and is collected (valueadded tax) WP Coupons

For example, if a product costs $100 and there is a 15% VAT, the consumer pays $115 to the merchant. The merchant keeps $100 and remits $15 to the government. The VAT system is used in 174.

Complete UAE VAT guide FinanceINME

Value-added tax (VAT) is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added, from initial production to the point of sale. The amount.

The Ultimate Guide to EU VAT for Digital Taxes

VAT: Value Added Tax Number is required for doing business in several European countries. You may need more than one VAT Number based on the countries in which you do business.. The VAT tax standard rate is 20% - VAT rates vary and are dependent on the product price. Online Marketplace, or OMPs, selling to customers in the UK are responsible.

How to Find a Business’s VAT Number? CruseBurke

What is a VAT number and how can I get one? Getting a VAT number means obtaining a tax identification number in a foreign country to carry out trading taxable activities. You should not confuse getting a VAT number with setting up a branch (permanent establishment) or incorporating a subsidiary.